Yes, it’s November 5th, Bank Transfer Day.

Remember, remember the fifth of November

Gunpowder, treason and plot.

I see no reason, why gunpowder treason

Should ever be forgot.Guy Fawkes, guy, t’was his intent

To blow up king and parliament.

Three score barrels were laid below

To prove old England’s overthrow.By God’s mercy he was catch’d

With a darkened lantern and burning match.

So, holler boys, holler boys, Let the bells ring.

Holler boys, holler boys, God save the king.And what shall we do with him?

Burn him!

http://twitter.com/#!/Jemima_Khan/statuses/132780357379563520

Don’t look now, but there’s something going on at the bank over there, George!

Occupy your own wallet by taking all your funds out of the Big Banks, putting them into your local credit union. You’ll get better service and better protections, you’ll own stock in a community business, and you’ll be helping make the world a better place.

Along with over one million Americans and counting:

That’s already about twice as many as switched from banks to credit unions last year, and when that video was made it wasn’t even November 5th yet! More switched in the month of October, 2011 than switched in all of last year.

“These results indicate that consumers are clearly making a smarter choice by moving to credit unions where, on average, they will save about $70 a year in fewer or no fees, lower rates on loans and higher return on savings,” said CUNA President Bill Cheney.

No relation to…you know…THAT guy.

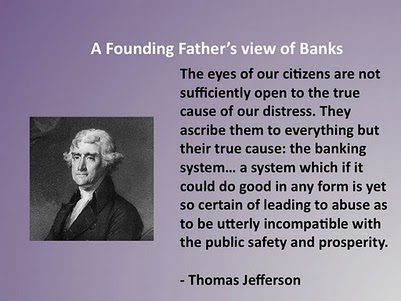

Are banks really that evil? Let’s ask THIS guy:

Scott Warren opened an account at JP Morgan Chase Bank in 2009 to receive unemployment payments.

Scott Warren mailed his statement to Chase after switching to a credit union. It said 'Dear Chase, Occupy Wall St., from your ex-customer.'"

“Chase was the only one that set it up for you,” said Warren, who was a quality supervisor at Unisolar in Greenville before being laid off. “I went to the unemployment office, they gave me my paperwork. I go to Chase, they set me up, and, right away, they’re trying to get me to sign up for a credit card.”

Warren was stunned. And it happened every time he went into a branch, he said.

“They knew why I was there,” he said, referring to his unemployed status at the time. “I told them I didn’t think that was smart. This tells me that they are not in business to serve my needs. They intend to make money off of my failures.”

Here in Vancouver, a call has gone out from Nancy Zimmerman, Moneycoach, to VanCity Credit Union, one of the biggest success stories in the industry:

In light of corralled girls and teargassed wheel-chair bound women and articulate youth and the hashtag #occupy showing up here, there, everywhere, does Vancity have something to offer? Yes, this vid gives a glimpse of a better way. It’s inspiring.

But it’s not a manifesto, and if ever a ballsy manifesto (nothing pretty, please! and no slick marketing!) was needed from a financial institution, one whose DNA is still gritty and radical even if tamed over the years, it’s needed now. Is a credit union something more than a kinder, gentler bank? I’m listening. And I hope about 99% of Canadian citizens are too.

Think there was no Canadian bank bailout?

Between September 2008 and March 2009, Canadian banks reduced their holdings of domestic residential mortgages from $486.1 billion to $434.9 billion according to Bank of Canada stats; on a net basis.

Where did those mortgages go, you ask? Did 10% of Canadian homeonwers sell their homes and move into rental accomodation enmasse during a six month period?

Of course not. The federal government created a unique program through CMHC specifically targeted at allowing Canadian chartered banks to move tens of billions of dollars of assets off of their balance sheets. The reason? Canadian banks couldn’t raise sufficient and/or cost-effective funding from their traditional sources – primarily other global financial institutions – and needed Crown intervention to keep the wolf from the door. By mid-November 2008, the federal government had agreed to take $75 billion of mortgages from Canadian banks.

Assuming the risk-weighting of these assets was 20%, the feds essentially put $15 billion of capital into the Canadian banks that participated in the $75 billion CMHC program.

More money for you, less for “Too big to fail” corporations that would no longer exist if your tax dollars hadn’t been used to prop them up when their own machinations dug a grave for them. No tie-dyed, herbal-tea-stained, smelly hippie radical protester fingerprints on any of it.

Taking back your own wealth while sticking it to The Man, making more money, and saving fees?

Ca-CHING!

UPDATES:

As of this writing, somebody’s posting to Facebook every 30 seconds that they ditched their bank in favor of a credit union…The campaign has caught on and credit unions reported a $4.5 billion surge in assets in October alone…

Should you wish to go about your business today or any other day wearing an Anonymous-approved Guy Fawkes mask, but hesitate to participate in consumerism by buying a mask copyrighted by Warner Brothers, you can print out a paper pattern for a 3D mask here, and you can find instructions on making an origami mask at the bottom of this post.

Bank transfer day? How about closings all accounts? The system doesn’t work! THE SYSTEM DOES NOT FUNCTION. The solution isn’t to transfer the money, it’s to get rid of the money! Trading posts seemed to be quite successful at some point in time. What happened to taking care of each other? What happened to humanity? What happened to our Spirit? We’re not just 99%, we are one, WE ARE ALL ONE.

Well done on this post – and thank you for going down and spending the time with the crew down there on social media – most certainly a noted improvement.

Many folks are ignorant to the fact that matters here are quite similar to those on the other side of our conceived border to the south – especially banking matters – a scrutinous eye reveals much once peering into the CMHC.

Thank you for all your efforts, and continued success in your endeavours.

Peter Pan, noble sentiments, but I’ll accept incremental improvement at this point. Trading posts were also quite successful when most things were manufactured and consumed within a 15 mile radius. It doesn’t work for the things we use now. Of course, we should re-evaluate consumerism, but I for one am not going to live without a laptop.

OccupiedInThought, thanks. I’m hoping to give another social media workshop Thursday evening, but I can’t take credit for them: they’ve taken what I told them and run with it. I often find that the most marginalized are the fastest to understand the true power of the Digital Revolution.

And a damn good thing, or The Powers That Be would have seen this all coming.

Pingback: Extensive Blow-By-Blow Account of Bank Transfer Day | OWSnews.org

Pingback: #HandsUpWalkOut: #Anonymous and #OpFerguson call for General Strike in Missouri «